Shrimp bytes

China’s March Imports Significantly Down, Putting Q1 2024 Imports 3% Behind Q1 2023

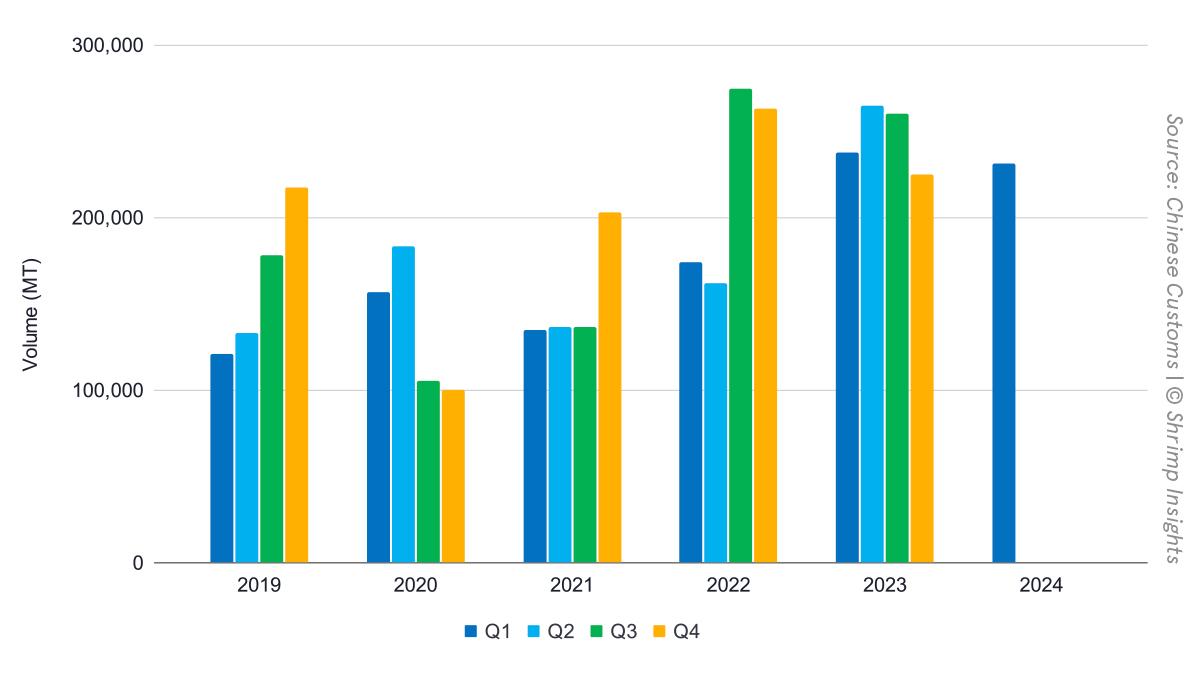

With 231,128 MT, China’s shrimp imports in Q1 2024 are still 3% ahead of Q4 2023 but 3% behind Q1 2023. After a solid year-on-year increase in January 2023 (+59%), imports in February and March dropped year on year, respectively -15% and -22%.

Looking at the largest suppliers in Q1 2024, Ecuador saw its exports drop by 5%. Although this drop is notable, Ecuador’s import volume in Q1 2024 is still far ahead of previous years, for example, 36% ahead of Q1 2022. On the other hand, India is continuing its slow surge in exports to China, with a 20% year-on-year increase, recording a new record of 30,911 MT in Q1 2024. The expansion of India into China may result from slow demand and uncertainty regarding import duties in the US. Other suppliers also experienced year-on-year growth in Q1 2024, such as Saudi Arabia (25%), Thailand (32%) and Peru (21%). Argentina and Indonesia saw a drop of 41% and 28% respectively.

The import value dropped to $1.1 billion, 15% below Q1 2023 and 2% below Q1 2022. In terms of average prices, there is some stabilization. Ecuador’s average import value dropped in January and February but slightly increased to $4.41 in March. India’s average import value dropped in January, stabilized in February, and then increased in March to $5.46. With the Chinese New Year behind us, the direction of prices will soon become more apparent.