Sitting at home, I’ve been trying to wrap my mind around the impact that Covid-19 is going to have on global shrimp demand. I’ve been wondering whether increased retail sales would compensate for reduced food service sales and whether the abruption of logistics at origin would result in a shortage of supply. The likeliness of inventories building up makes me worry that prices will take another hit by August and September when the crop that farmers have now stocked will be harvested. Will farmers once again be forced to sell at prices that hardly allow them to break even? In this blog, I’ll delve into the latest available trade data to try to make some early observations and careful predictions on global demand for Penaeus vannamei (P. vannamei) shrimp for the second half of 2020. Let’s look at the situation in China, the US and Europe.

China’s imports are flat or slightly down

China was in lockdown between February and May 2020. The lockdown inevitably had an impact on Chinese demand for shrimp and resulted in a decline of shrimp consumption in China’s food service segment. With most restaurants having had to close their doors for several months, suppliers have not been able to move wholesale products through their cold stores. But the impact was not only felt in China’s food service segment: shrimp demand from the reprocessing industry has also taken a hit as factories were closed for quite some time due to labor restrictions during the lockdown. Keeping these two factors in mind, I would have expected to see a decline in imports reflected in trade data.

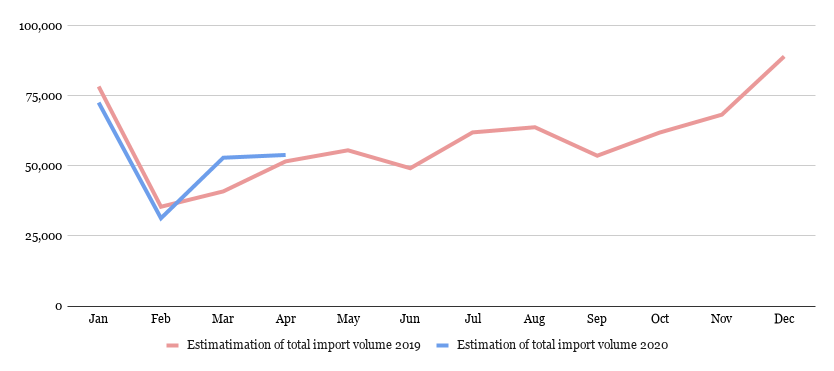

Graph 1: China’s shrimp imports of HS030617 in 2019 and 2020

Source: Chinese customs and Ecuador’s Chamber of Aquaculture

Notes:

* Chinese customs report January and February 2020 data as one single month. I’m assuming here that 70% of the volume was actually imported in January and 30% in February. This would be in line with the import trend of 2019.

** The data in this graph combines China’s total imports reported by Chinese customs and Ecuador’s exports to Vietnam as reported by Ecuador’s Chamber of Aquaculture. Together, these numbers provide a good estimate of China’s total shrimp imports.

However, trade data is telling us a different story. Direct imports were down year-on-year in January. However, in February, March and April, direct imports were significantly up. Looking at the year-to-date (YTD) total in April, direct imports increased from 161,160 tonnes in 2019 to 209,980 tonnes in 2020. If we would stop here and not look any further, we could conclude that Chinese demand hasn’t suffered from the lockdown at all.

Appearances can be deceiving, though, and so can (official) data. Looking a bit further, I arrive at a different conclusion. China’s customs data does not include shrimp that’s smuggled into China through Vietnam. For that, we need to look at Ecuador’s exports, which have been reported for January until April by the Chamber of Aquaculture (Cámara Nacional de Acuacultura, CnA). Ecuador’s export data shows that its exports to Vietnam in the period from January until April declined from 46,576 tonnes in 2019 to a mere 708 tonnes in 2020.

If we correct China’s total imports for the decline of imports of Ecuadorian shrimp through Vietnam, China’s overall imports in the first four months of the year increased only from 207,737 in 2019 to 210,688 in 2020. Bearing in mind that India and other countries also likely reduced their indirect exports to China, my assumption is that actual YTD Chinese imports in April were already behind those of 2019.

Looking at the supply trend of China’s two major suppliers, I have to conclude that Ecuador is the driving force behind the stability of overall Chinese imports. Ecuador’s YTD direct and indirect exports to China are up by 11% compared to 2019. Over the same period, India saw its direct exports to China decline by 10%. If indirect imports (though India’s trade data is not available yet) are taken into account, it’s not unlikely that India’s exports will turn out to have declined by even more than 10% year-on-year.

As Ecuador performed very well while sales should have been down, I think it’s likely that inventories of Ecuadorian shrimp in China are high. This would suggest that for the coming months, prices of Ecuadorian shrimp remain under pressure at least till September when Chinese buyers start to prepare their orders for the holiday season. Hopefully, all things going as planned, this holiday season will help the industry recover a bit and get its game back.

Prices for small sizes of P. vannamei from India, or any of its competitors, really, have a more positive outlook for the coming month as the Chinese reprocessing sector is back on track and so demand there will increase. And, as the supply of small sizes of shrimp from India is not so abundant, Chinese demand for these smaller sizes block frozen P. vannamei may drive up the prices. By September, though, I expect that these prices will come more under pressure as a new harvest by Indian farmers is expected.

US imports in 2020 have so far outperformed 2019 every month, even in April (+6%)

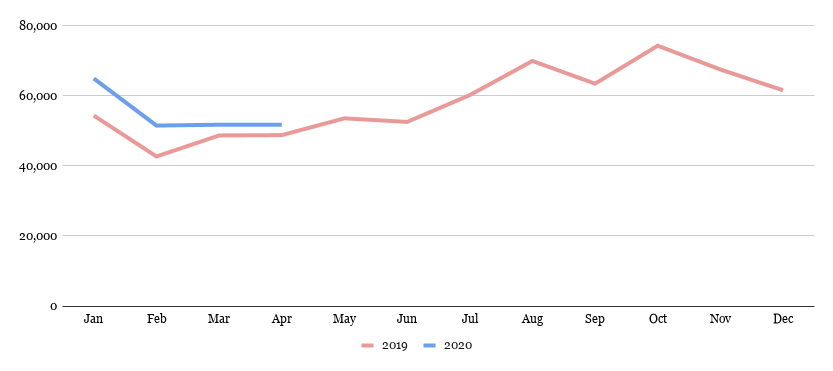

Graph 2: US imports of warmwater shrimp in 2019 and 2020

Source: NOAA

Although Trump was playing down the pandemic till recently, in April it became clear that the impact of Covid-19 was so severe that almost the entire country had to go into lockdown. The extent and the duration of the lockdown varied from state to state. Consumption never came to a hold entirely, but with shrimp mainly being consumed in restaurants, I expected – same as for China – that US import data would reflect a negative trend during the pandemic.

In reality, the import data of the first four months of 2020 reflects the opposite. The US has outperformed 2019 for every month. In January and February, the US imported around 20% more than in 2019. In March and April, this number came down to about 6%. Looking at the YTD total, the US has imported 13% more shrimp in 2020 than in 2019.

India, Indonesia and Ecuador all performed really well. Ecuador increased its exports to the US significantly during this year’s first quarter. However, when China slowly got out of its lockdown in April, Ecuador’s exports to the US immediately dropped while its exports to China increased. That same month, Indonesia increased its YTD export volume to the US by 29%. In April alone, its exports to the US increased by 44%. India, though, remains by far the largest supplier of the US and, by April, increased its YTD export volume by 22%.

The good news for exporters to the US is that the average value per kilogram has not dropped significantly. While only at 90% of the level of 2018, the value in 2020 is similar to what we saw in 2019. In April 2018, the average value per kilogram was $9.48, dropped to $8.26 in 2019 and has since increased slightly to $8.49 in 2020. Although this number is also influenced by changes in product types, we would see a drop if prices had declined drastically.

Like Ken Salzinger, the man behind seafood blog Ken’s Catch, also said in one of his recent blogs after seeing the April numbers, if there wasn’t a glut of shrimp in the US yet, there surely is one now. Due to the closure of the food service segment, and bearing in mind that shrimp is more a food service than a retail product, inventory must have piled up.

Despite the glut of product in the US market, prices for larger sizes likely won’t decline much until August or September. Asian production of medium and larger sizes P. vannamei has been limited this year so far. A new harvest is not expected before the end of August, so current demand can likely sustain the current price level or even support a slightly higher price level. However, it’s not unlikely that prices for larger sizes will also take a hit once the new harvest arrives and inventories haven’t yet been sold.

A final note for the US is that retail sales have increased (due to people eating at home instead of in restaurants), which may soon result (or maybe already has) in increased demand for BAP certified products. Where the US traditionally sources most of its BAP certified products in India, a potential shortage of BAP certified products may increase raw material prices in India, and cause buyers to look at alternatives in Indonesia, Vietnam and potentially Ecuador.

Europe’s imports, particularly Italy (-95%), dropped significantly from April onward

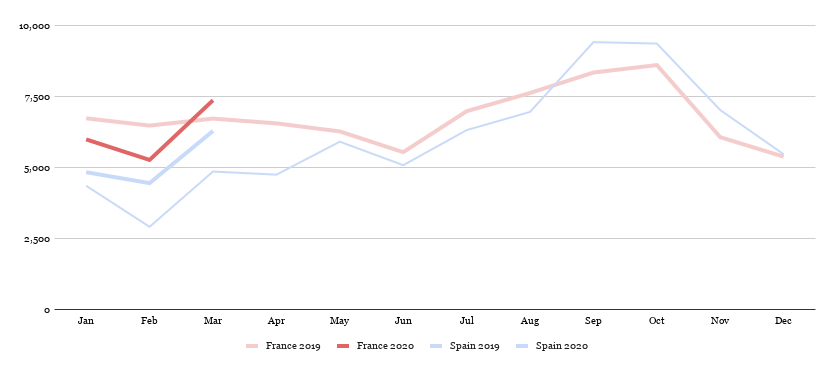

Europe is always way behind with reporting its import figures, which makes it a bit more difficult to interpret the market situation. The latest data available for Europe as a whole is March 2020. To get an idea of what has been happening in Europe, we can look at France and Spain, Europe’s largest P. vannamei markets, which in 2019 imported about 71,000 and 73,000 tonnes, respectively.

France experienced a sluggish start with its shrimp imports at the beginning of this year. In January and February, France imported only 89% and 81% of its imported volume in 2019. In March however, it imported 10% more. In March, its YTD total imports were 7% behind 2019. Spain, on the contrary, had a good start. In January, February and March, Spain imported 11%, 53% and 29% more shrimp than in 2019. Spain’s YTD total in March was 28% ahead of 2019.

In Southern Europe, Italy was the first country to announce a lockdown on 9 March. Spain and France quickly followed suit, announcing lockdowns on 14 and 16 March, respectively. As is clear from the graph below, March imports were not yet affected and importers in France and Spain did not at all appear cautious with regard to the coronavirus outbreak yet.

Graph 3: France and Spain’s P. vannamei imports in 2019 and 2020

Source: ITC Trademap

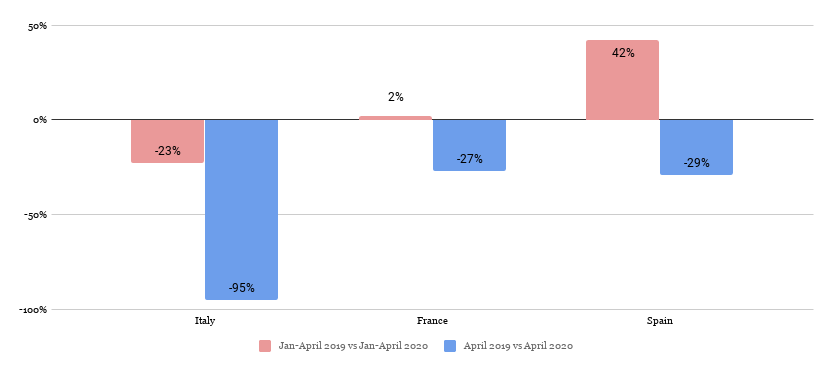

To better see the effect of the lockdowns in Southern Europe, we should look at Ecuador’s April export data. The graph below shows Ecuador’s exports to Italy, France and Spain for January-April 2019 and 2020. The graph compares the April YTD performance and the performance in April alone.

Graph 4: Ecuador’s exports of P. vannamei to Southern Europe in 2019 and 2020

Source: www.cna-ecuador.com

Italy’s numbers in particular speak for itself: in April, Ecuador’s exports to Italy dropped by 95%. In France and Spain, where P. vannamei is more a retail than a food service product, imports dropped by 27% and 29%, respectively. Although the graph only shows data from Southern Europe, Ecuador’s exports to Northern Europe also dropped drastically in April with year-on-year negative growth rates of 75%, 69% and 21% for the UK, Germany and Belgium, respectively.

If we’re to take Ecuador’s exports as an indicator of the overall market performance of P. vannamei in Europe, the April numbers are likely marking the start of a couple of months with very limited P. vannamei shrimp imports.

Prices at origin may increase until end of August but are likely to take a hit when Asia’s new crop is harvested in September

Looking at the performance of the three major markets in the first months of 2020, it’s likely that the large volumes of product brought into the market in the first quarter have not been sold entirely but are sitting in the cold stores instead. Keeping in mind these high inventory levels of food service suppliers, I think demand for new product won’t be gaining strength till September, when (hopefully) new orders for the holiday season will be made.

In the short term, my careful prediction is that prices at origin may increase. Producers have now started on their new crop but the big harvests are not expected until the end of August. Because of strong demand from retail suppliers who have been continuing or even improving their business during the Covid-19 lockdown, prices for certified raw materials and prices for certain sizes may go up until the end of August.

In the mid-term, when Asia’s farmers harvest their crop from the end of August, I doubt that demand can sustain the price levels that we are now heading towards. Although prices for certain sizes and certified raw materials may be stable, I expect those for the bulk of production to come under pressure as inventories may still be high and supply from the new crop is likely to outgrow market demand.