In this blog, I’ll share data provided by CNA Ecuador that gives us insight into which of Ecuador’s processors are responsible for the growth of Ecuador’s exports. I will also share data provided by ASC, BAP and SSP about the effect of the drive for market diversification on the number of certified farms and the volume of certified shrimp that can be supplied to high-end markets in especially Europe and the US.

The Shrimp blog is sponsored by Grobest, Inve Aquaculture, DSM Animal Nutrition, American Penaeid Inc., Zeigler Nutrition, Aqua Pharma Group, Mega Supply, and Undercurrent News.

Ecuador Continues Breaking Records, while Depending Slightly Less on the Chinese Market

Ecuador continues to break export records. The country’s October export numbers show that the year’s total volume is up by 31% at 672,136 MT, while the value is up by 19% at $3.9bn compared to 2020. The average value is up by 10% at $2,67/lbs. This means that exporters could count on higher prices compared to 2020 and/or have exported more value-added products. Not a bad year you could say. But it gets even better.

In terms of market diversification, Ecuador’s dependency on China is down from 53% in 2020 to only 45% in 2021 so far. The US gained the most in terms of Ecuador’s total export share and is up from 18% to 22%. Europe, up by 1% to 24%, remains the second-largest market for now, but if this trend continues, the US may take over in 2022. Europe’s and the US’s joint market share of 46% means that the risk of Ecuador being overly dependent on the Chinese market is reducing.

But did all of Ecuador’s exporters benefit equally from these developments?

Santa Priscila Breaches 110,000 MT Barrier, Omarsa Breaches 80,000 MT Barrier and Songa Close to Breaching 60,000 MT Barrier

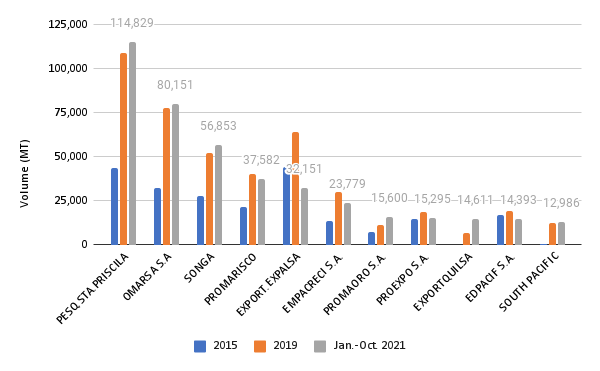

Figure 1 shows the export volumes of Ecuador’s largest exporters. We can see their export trends from 2015 to 2019 and from January to October 2021.

Figure 1: Ecuador’s top 10 exporters in 2015, 2019 and Jan.-Oct. 2021

Source: www.cna-ecuador.com

Note: Unfortunately, I haven’t been able to receive information on what’s behind the drop in Expalsa’s exports and whether there’s a chance that some of its exports were done under another name. This also applies to the other numbers presented in this section. Some of the changes may result from companies declaring their exports differently.

As of October 2021, the top 3 exporters – Santa Priscila, Omarsa and Songa – have already outgrown their 2019 year-total exports by respectively 5%, 3% and 9%. Compared to 2019, the joint market share of the top 3 remained stable at 37% of total exports. But compared to 2015, their joint market share is up by 5%, showing their increased dominance of Ecuador’s exports.

The increase in market share is mainly accounted for by Santa Priscila which went up from 13% to 17% on its own and increased its exports from 44,000 MT in 2015 to 114,000 MT in January-October 2021. I cannot think of any other company – except for possibly Mitsui-backed Minh Phu in Vietnam – that even comes close to the volume of shrimp that Santa Priscila is trading.

Omarsa follows closely as the second-largest exporter at an impressive 80,000 MT, up from 32,000 MT in 2015. Today, Omarsa represents 12% of total exports, compared to 10% in 2015. Songa concludes the top 3 with 57,000 MT, up from 28,000 MT in 2015. Just like in 2015, Songa currently accounts for 8% of total exports. There’s no other country in the world where the top 3 exporters account for such a large share as in Ecuador.

Looking at the export figures that I received from CNA, 5 of the other top 10 exporters did not (yet) outperform 2019’s year-total. Especially Expalsa – dropping from number 3 with 64,000 MT in 2019 to number 5 with 32,000 MT in October 2021 – showed a very weak performance compared to 2019 and is even down compared to 2015 when it still exported 44,000 MT.

Although at Least 10 Times Smaller than Santa Priscila, Some Exporters Have Been Able to Significantly Grow Their Shipments

While volumes of between 5,000 MT and 16,000 MT may seem insignificant compared to the numbers of the top 3 exporters, these exporters are still significant if we also look at the size of shrimp exporters in other parts of the world. Exporting 5,000 MT of shrimp still equals shipping around 250 containers per year; much more than most EU importers would purchase every year. Just for your reference, in Bangladesh, which is one of the world’s largest exporters of P. monodon shrimp, not one of the exporters will ship anywhere close to this amount. The average export volume per company in Bangladesh is closer to 1,000 MT.

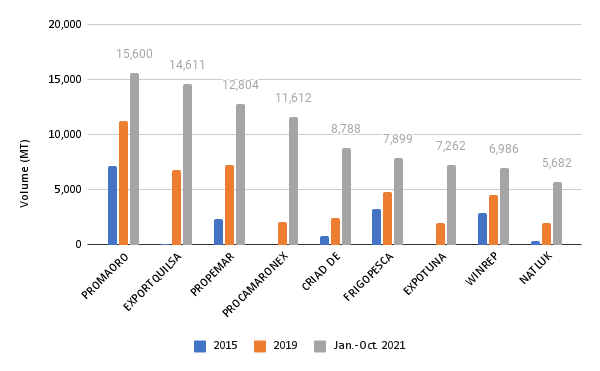

Figure 2: Companies that have grown their exports most significantly

Source: www.cna-ecuador.com

Let’s take a closer look at the companies in Figure 2.

Some of them have a farming background and only more recently became involved in processing and exporting their own products.

Promaoro is the first of such companies. This year its production already surpassed 15,000 MT and the company may even close the year at around 18,000 MT; over 50% up from 2019 and more than double the amount of 2015. Founded only in 2013, Promaoro states that it owns 800 ha of farms which cover around 30% of its capacity, and that it sources the remainder of its shrimp from other farms. It wants to become the largest exporter of the El Oro province, close to Guayaquil.

ExportQuilsa was still absent in 2015’s export numbers, but the company has existed since around 2007 when it started to cultivate shrimp. In 2011, the company started marketing its own shrimp which it processed elsewhere. ExportQuilsa then opened its own processing plant in 2018 or 2019 and its exports grew from around 6,000 MT in 2019 to most likely around 18,000 MT by the end of this year.

Some of the companies originate from the fishing industry and are well-known exporters of wild-caught fish and seafood.

Natluk, a well-known exporter of tuna and other wild-caught seafood and one of the companies upping their shrimp game, saw its export volume exceed 5,600 MT back in October and may close the year at around 7,000 MT. Expotuna and Propemar chose a similar path: the latter has been involved in seafood exports for more than 15 years, but out of nowhere will have exported around 15,000 MT of shrimp by the end of this year. These companies clearly cannot ignore the demand for shrimp from some of their traditional wild-caught fish and seafood customers.

Others – such as Frigopesca, Procamaronex and also Winrep – are standalone processors and exporters that have seen production grow and are now trying to capture market share among independent farmers across Ecuador’s shrimp farming belts.

Whatever their background, these companies are growing rapidly. It’s good to keep an eye on how their shrimp exports evolve over the next couple of years.

ASC Significantly Increased Its Number of Certified Farms and Their Volumes

Let’s also have a quick look at certification. As many of Ecuador’s exporters are trying to diversify their markets, they have to work on certifying their farms. This has resulted in a drastic increase in the number of farms with BAP and ASC certification and a rapid growth of the volume of certified shrimp that these companies can ship.

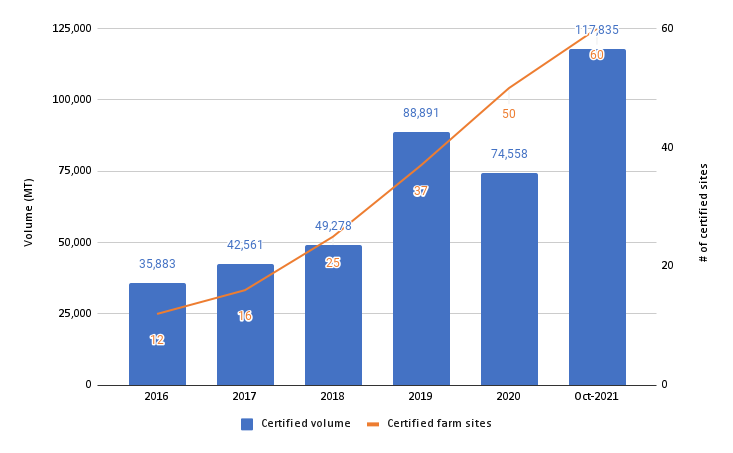

Figure 3: Number of ASC certified farms and volume of shrimp they can produce according to farm’s capacity

Source: Aquaculture Stewardship Council

Figure 3 shows that the number of certified farming sites and the volume of certified shrimp they can produce increased drastically, especially after 2018. Between 2018 and 2019, the certified volume increased from 50,000 MT to 89,000 MT and the number of farming sites increased from 25 to 37. Since then, save for a dip in 2020, the number of farming sites grew further to 60 in 2021, while the certified volume reached 118,000 MT. The drop in number of certified farming sites happened due to a couple of failed audits and certification cancellations. ASC told me that it finds it important to mention that if ASC farms don’t comply with the regulations, they face the risk of a failed audit and withdrawal of their certificate.

In terms of numbers of certified farms, ASC is clearly ahead of BAP as at the moment only 17 of Ecuador’s shrimp farms are BAP certified. There’s significant overlap between the farms that are ASC certified and the ones that are BAP certified, which means that a lot of the large farms possess double certification. BAP has further certified 10 shrimp processing plants while the chain of custody of 21 processors and/or exporters is approved to handle ASC products. With Ecuador’s push into the US market I do expect more Ecuadorian farms to obtain BAP certification in the future.

Although ASC’s – and to a certain extent BAP’s – numbers are great and ASC certified volume today represents 18% of Ecuador’s total shrimp production, the number of certified farming sites is only a fraction (1 or 2%) of the total 3,500 farms in Ecuador. The vast majority of producers are still not certified and may not get certified anytime soon, most likely because they’re selling to markets where the consumer isn’t asking for it (yet).

Although the Number of SSP Certified Farms Isn’t Growing Significantly, the Effect of SSP on Ecuador’s Market Image Is Most Likely Noteworthy

Ecuador’s Sustainable Shrimp Partnership (SSP) is another driving force behind the country’s desire to diversify its markets. The partnership requires accredited farms:

- to be ASC certified and provide further guarantees of traceability of their products through IBM’s blockchain platform;

- to use zero antibiotics throughout the production process; and

- to have a neutral impact on the water that they use.

With these requirements, SSP aims to set Ecuadorian shrimp apart from other, mainly Asian shrimp. And it’s very successful in doing so.

Today, only 3 companies can distribute SSP certified shrimp – Omarsa, Songa and Promarisco (subsidiary of Nueva Pescanova) – and about 10 farms that can supply SSP certified shrimp to these 3 companies. However, together with its partners (IDH, WWF and ASC), SSP has worked towards implementing an aquaculture improvement project to help 22 smaller farmers to work towards ASC certification. SSP hopes that these 22 farms will get certified soon. A new project will start in 2022 and aims to result in more certified smaller farms.

Although the number of SSP certified farms remains small even with the 22 new farms included, the impact of the partnership goes beyond the production and sale of SSP certified products. The strong marketing and communication strategy behind SSP and the way it highlights the sustainable nature of Ecuadorian shrimp, impacts the image of Ecuador’s entire shrimp industry.

While I'm not sure whether retailers in Europe and the US are willing to pay more for SSP certified products after having already committed to buying only BAP or ASC certified shrimp, I’m pretty sure that SSP partners will see a return on their investment as many retailers in Europe are increasingly including Ecuador as a possible country of origin in their tender documents.