In October, there will be three shorter ShrimpInsights blog posts instead of one long one. Each will address some interesting facts that you don’t often read about, and which concern India, Vietnam, and Indonesia. This first blog reflects on India’s 2021 broodstock imports.

The Shrimp blog is sponsored by Grobest, Inve Aquaculture, DSM Animal Nutrition, American Penaeid Inc., Zeigler Nutrition, Aqua Pharma Group, Mega Supply, and Undercurrent News.

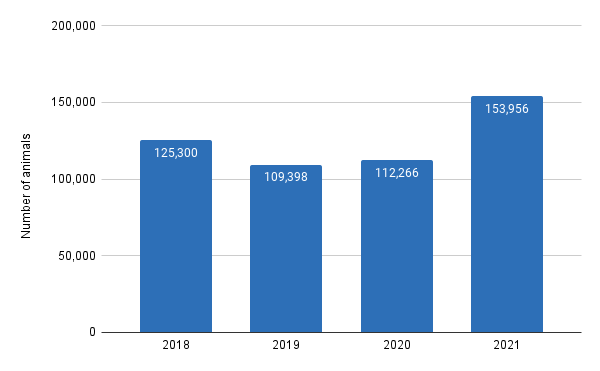

Broodstock Imports Over the First Half of 2021 Broke the Previous 2018 Record

In the previous blog, I already mentioned that India’s broodstock imports during the first half of 2021 exceeded the volumes of 2018, 2019, and 2020 by 23%, 41%, and 27% respectively. Clearly, this broodstock catered to the hatcheries producing PL for the summer crop, which turned out to be exceptionally good. A compulsory stop of broodstock imports due to a closure of the Aquaculture Quarantine Facility (AQF) during July and August may have caused some delay in PL availability for the winter crop, although most hatcheries will already have had sufficient stocks in their hatchery or procured broodstock from MPEDA’s Broodstock Multiplication Center (BMC). While no broodstock was imported, the local BMC produced 2,000 broodstock in August and a similar number in June.

Figure 1: The number of broodstock imported to India from January to June from 2018 to 2021

Source: Aquaculture Spectrum

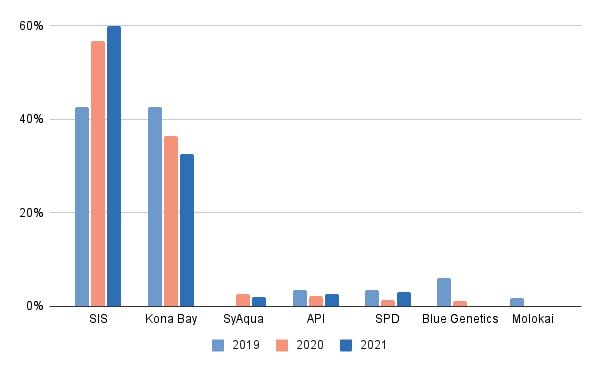

Shrimp Improvement Systems (SIS) Increased Its Market Share to 60% of Total Imports at the Cost of Kona Bay

Kona Bay’s market share has been continuously falling since 2018, and this year it stands at only 32%. In 2020, Kona Bay struggled with its logistics from Hawaii due to COVID-19-related challenges. In 2021, Kona Bay doesn’t seem to have managed to regain its market share despite improved logistics from Hawaii. SIS has taken over most of Kona Bay’s market share, but now exports practically all of its broodstock into India from its facility in Florida – in 2019, exports to India from its facility in Hawaii still accounted for around 13% of its exports. Despite the fact that Kona Bay’s market share is falling, it seems that other suppliers who have expressed their ambition to penetrate the Indian market haven’t yet been able to do so.

Figure 2: Market shares of broodstock suppliers of total Indian broodstock imports

Source: Aquaculture Spectrum

Bram Geurts, Director of Sales and Marketing at Hendrix Genetics (owner of Kona Bay), explains that international logistics from Hawaii have not stabilized yet, leading to a backlog of orders. According to Geurts, at the moment, demand for Kona Bay shrimp exceeds its shipping capacity. This further underscores the relevance of Kona Bay’s strategy to establish local, in-country BMCs to offer high-quality broodstock, with the same genetics as the US broodstock, but reared in local conditions and not exposed to the stress and risk of long-haul transport. Without revealing whether one of these BMCs will be established in India, he says that the launch of Kona Bay Indonesia in 2021 (a joint venture with JAPFA) has proven the success of this strategy. According to Geurts, for now Kona Bay remains one of the two market leaders in India, and sees an opportunity to capture at least the growth of the Indian industry.

David Leong, CEO of SIS, explains that having a facility in Florida allowed SIS more logistical options when disruptions to normal shipping routes occurred due to the pandemic. When I asked about the current market shares of its different genetic lines (SIS sells a Growth Line, a Balanced Line, and a Hardy Line), Leong informed me that the vast majority of its animals shipped to India still come from the Growth Line. According to him, the Growth Line is still one of the fastest growing animals in India and the majority of Indian farmers continue to target larger size animals in the shortest amount of time to minimize risks and improve productivity. He believes this product will continue to generate interest from industry stakeholders year-round in farms with improved infrastructure, and proper pond preparation and biosecurity management.

SIS’s Hardy Line, which has been under development for the last 5 years, was introduced in India in 2019. Though not bred especially for growth, Leong explains that SIS observed its performance in challenging environments was able to meet the farmers’ requirements. Sales of the Hardy Line against total sales was 1% in 2019; 15% in 2020; and is projected at 30% for 2021. The Hardy Line is primarily an animal for challenging environments, especially summer and storm seasons. According to Leong, weather fluctuations are more common in these seasons: summer crop temperatures can reach 35-39 degrees, and then abruptly taper off as the monsoon season approaches.

Blue Genetics Halted Supplies to India Entirely and Other Suppliers Failed to Gain Market Share

Besides the drop in market share of Kona Bay and the increase in market share of SIS, an interesting observation is that Blue Genetics (the Mexican partner of the privately-owned BMC of BMR Blue Genetics) has entirely halted its exports to India. Apparently, this is a result of positive disease tests in some of its shipments to India. It's unclear whether and when Blue Genetics can start exports to India again. As a result, the BMC has not been producing any broodstock this year. This can explain at least part of the increase in broodstock imports during the first half of 2021.

Market Shares of India’s Top 5 Hatchery Groups Remain Relatively Stable But There Are Some Noticeable Changes

India’s hatchery market remains extremely fragmented with the top 5 hatchery groups only accounting for around 25% of the total market. Although there seem to be some changes in the shares of broodstock imports among the top 5, these don’t necessarily reflect changes in market shares. SVR Group may have been the only group that actually saw its market share drop slightly. Let me explain why.

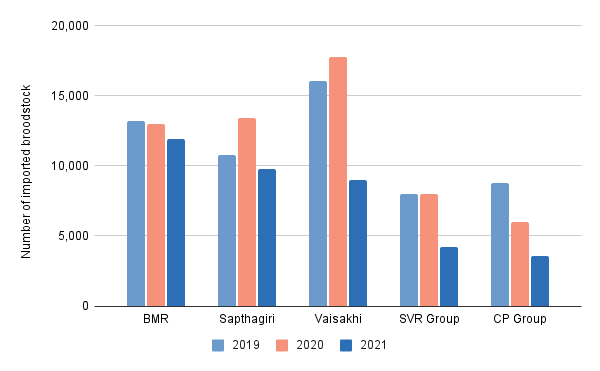

Figure 7: Broodstock imports for January-December 2019 and 2020, and January-June 2021 for India’s top 5 hatchery groups

Source: Aquaculture Spectrum

Note: Jointly, these 5 groups represent around 25% of the broodstock imports.

Note: Sapthagiri Group owns multiple hatcheries and different sources count different hatcheries as belonging to the group. So far, I have been unable to fact-check the actual group members with the company itself. In Figure 3, the hatcheries grouped under Sapthagiri are Sapthagiri Hatcheries, Srinivasa Hatcheries, and Venkata Sai Hatcheries.

This year, BMR Group is the largest broodstock importer. However, this isn’t necessarily the result of an increase in market share but rather of the (temporary) closure of its BMC which I already mentioned above. I assume that BMR has – at least to some extent – increased its imports of broodstock to compensate for its own broodstock production. I haven’t been able to confirm this assumption with representatives of the company.

While Vaisakhi and CP Group have seen their share in imports drop, they’ve been the major buyers of broodstock from the MPEDA BMC, which produced around 10,000 broodstock in February and March, and around 2,000 broodstock in June and August respectively. Vaisakhi procured all broodstock produced by MPEDA’s BMC in August and as such was the only hatchery that had “fresh” broodstock to produce PL with for India’s farmers in the first period after the AQF closure. If we add Vaisakhi’s broodstock procured from the MPEDA BMC to its imported broodstock, then Vaisakhi is still the largest broodstock buyer in India.

In 2021, Kona Bay Is Still the Exclusive Supplier to 3 of India’s Top 5 Hatchery Companies

Kona Bay continues to supply all imported broodstock to 3 of the top 5 hatchery groups: Sapthagiri, SVR, and CP Group. SIS dominates the market among India’s smaller importers and has some loyalty from BMR and Vaisakhi, which are both also responsible for the largest share of imports from smaller suppliers (BMR procures the majority of supplies from Sea Products Development while Vaisakhi procures a considerable part of American Penaeid Inc.'s supplies).

Next Week: Some Interesting Facts About Vietnam

In next week’s short blog, I will discuss Vietnam’s export data for different shrimp species and reflect on the major players for each species. Stay tuned!