As many know, besides running Shrimp Insights, I’m the co-founder, board member, and managing director of the Global Shrimp Forum (GSF) Foundation. Earlier this month, we concluded the second edition of the event.

One of my favorite sessions was the one on China. You cannot imagine how hard it is to find people who can and are willing to give a proper insight into the Chinese shrimp production sector and the way it is evolving. Therefore, I was thrilled when we could confirm that Dr. Fuci Guo, Global Aquaculture Category Manager at Royal Agrifirm, would be sharing the insights he collected during recent visits to China’s main shrimp farming areas. My excitement grew when we confirmed Dr. Ronnie Jin, Senior Partner at AquaOne, Fang Qing, General Manager China at ASC, and Fred Kao, CEO at SyAqua, to join a panel to dive even deeper into the Chinese shrimp production and markets. Thank you, Fuci, Ronnie, Qing, and Fred! It was truly an honor to have you with us.

Video 1: Presentation of Dr. Fuci Guo at the Global Shrimp Forum 2023 in Utrecht, the Netherlands

Credit: GSF 2023, Utrecht, the Netherlands

One of the central questions we asked Dr. Guo and the panelists was whether they believed that Chinese domestic production could soon compete with imports from Ecuador and other overseas origins or whether both supply streams could grow hand in hand. In this blog, I will summarize the key insights of the GSF session on China and reflect briefly on what this means for the wider global shrimp industry.

In 2023, the Shrimp Blog is supported by: Inve Aquaculture, Taprobane Seafoods, DSM-Firmenich, Zeigler Nutrition, aquaconnect, Bioiberica, Megasupply, American Penaeid, and Omarsa.

Understanding China’s Production Geography and Production Systems Variety

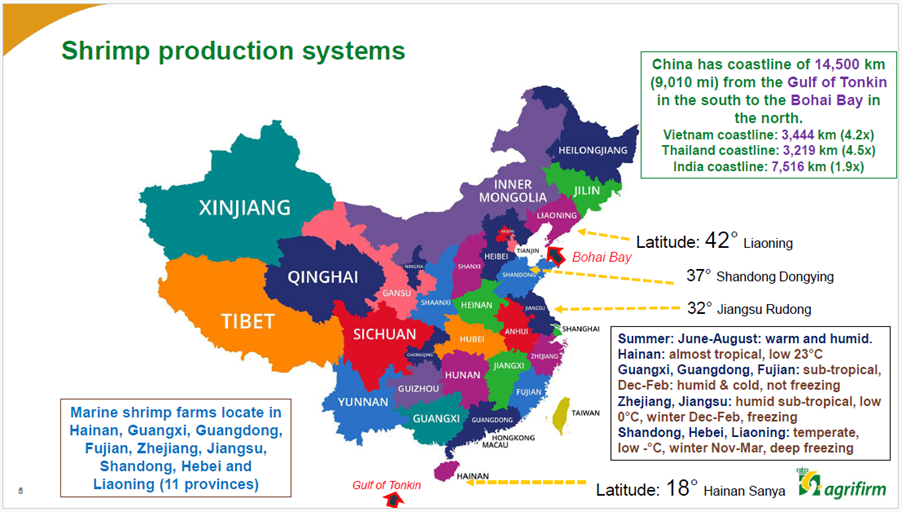

Dr. Guo explains that before diving into China’s shrimp production, we first must understand China’s geography and the various production systems used. He, therefore, starts his presentation by pointing to China’s long coastline of more than 14,000 km, which is longer than the combined coastlines of India, Thailand, and Vietnam.

Source: Dr. Fuci Guo, Royal Agrifirm (GSF 2023, Utrecht, the Netherlands)

China’s shrimp farms are located in 11 provinces along the coastline from 18 degrees latitude in Hainan to 42 degrees in Liaoning. Climatological conditions vary widely from South to North. While summers are warm across the board, the further North one goes, the colder and longer the winters become. It’s common to have temperatures below zero for several months in provinces like Shandong, Hebei, and Liaoning. Farming systems have evolved around the climatological conditions in each part of the country.

Source: Google Maps

The original farming region where farmers grow shrimp in earthen and lined ponds is located in the Southern provinces of Guandong, Guanxi, Hainan, Fujian, and Zhejiang. Production in earthen and lined ponds represents around 70% of China’s saltwater shrimp production. But the conventional farming sector in the South is confronted with a range of challenges that prevent further growth, including (1) remaining disease prevalence due to a lack of biosecurity, (2) damage from heavy rains and storms during the typhoon season, and (3) regulatory pressure from the Chinese government regarding land and water use and pollution.

While previously responsible for the lion’s share of production, Dr. Guo doesn’t think these conventional farms have been responsible for much growth over the past couple of years, nor that they will be the drivers of future growth. For that growth, we need to look at the rapid expansion of greenhouse farms over the past decade and the recent rise of recirculating aquaculture system (RAS) farms.

Rapid Expansion of Small-Scale Greenhouse Farms Close to Shanghai May Account for 450,000 MT Annually

Jiangsu is a province located on China’s coastline at 18 degrees latitude, just above Shanghai (see Figure 1). Production in small greenhouses in Jiangsu has exploded over the past decade. More recently, small greenhouse farms also arose rapidly in the South. Referring to information from local authorities, in a discussion I had with Dr. Guo after the GSF, he stated that in 2023 there were around 200,000 small greenhouses in Jiangsu alone, and another 250,000 in the South in Guanxi, Guangdong and Fujian. While the farms in Jiangsu can only manage one to three crops per year due to the cold winters, the farms in the South can easily manage more than three harvests. Dr. Guo calculates that with an average of three crops per year and around 15 MT/ha per crop, these farms combined can produce around 450,000 MT annually.

Although some of the panelists argue that this is an overstatement as Dr. Guo did not correct his calculation for crop failure, if we were to assume that this is anywhere close to reality, such a number would constitute almost 30% of China’s saltwater shrimp production. Located close to Shanghai and the cities around it, these small greenhouse farms are ideally located to supply shrimp to the fresh markets in this urban conglomerate where wholesalers are likely willing to pay a high price for fresh produce.

Source: Google Maps

So, what are we talking about? The small greenhouse farms consist of small ponds (0.04ha and 1m depth) covered with steel frames and plastic sheets (see Figure 3). Stocking densities are typically around 75-100 PL/m2. The ponds are generally earthen without any linings. Investment costs would be around $7,000 per unit. Farmers try to achieve two to three crops annually and harvest 12-30 MT/crop/ha with several partial harvests to keep the biomass under control. Farmers use biofloc technology, nanotube aeration, and large amounts of probiotics to maintain water quality. There are no central drains or other technologies like in the outdoor ponds. Water exchange in these systems is low compared to the traditional earthen and elevated ponds. Farmers use heating systems to control water temperature and thus can lengthen the farming season into winter and the Chinese New Year. Although temperature can be controlled and the ponds are protected from rain, they are prone to damage from typhoons, and to crop failures as disease is prevalent.

Although these small greenhouse farms have been responsible for a lot of production growth over the past decade—possibly also compensating for a decline in production from traditional shrimp ponds in the South—problems now loom. The Chinese government has started enforcing stricter water and land use regulations. The use of groundwater and the discharge of polluted water by these farms has long been a cause of concern. Several of the panelists confirmed that it is likely that the government will restrict further expansion in Jiangsu. Therefore, it’s unsure whether these small greenhouse farms will be responsible for much further growth of China’s shrimp production.

RAS Farming Projects May Become Vital for China’s Domestic Shrimp Supply in the Longer Term Future

The panelists and Dr. Guo agree that the future growth driver in China will be the RAS farms close to many of China’s urban centers. According to Dr. Guo’s research, between 2014 and 2023, the area under cultivation in RAS farms reached 8m m3, but production represents just a minor fraction of China’s total domestic shrimp production.

The RAS farms are primarily located along the middle and North of China’s coastline in Shandong, Hebei, Tianjin, Jiangsu, and Liaoning. Many smaller operators have started growing shrimp in RAS farms, among whom Dr. Ronnie Jin, who represents AquaOne in the GSF China panel discussion. But China’s aquafeed giants such as Tongwei, Haid, CP, and Evergreen are also investing heavily, and eight of their farms currently account for 2m m3 of the total. Although production from RAS farms across China still represents less than 5% of total production, the future seems bright.

A Bird’s Eye View of AquaOne’s Hatchery and Grow-Out Facilities in Tangshan, Hebei, China

One of the panelists in the China session of this year’s GSF is Dr. Ronnie Jin, AquaOne's Senior Partner and Vice General Manager. AquaOne Group runs a genetics program, produces and sells broodstock and post-larvae (PL), and grows shrimp for sale to consumers. While some of AquaOne’s founders previously worked in the shrimp broodstock business in various roles at SyAqua, Primo Broodstock, and Hawaii’s Oceanic Institute, Dr. Jin worked with Alibaba’s Jack Ma at Goldrain Ocean and brought expertise from a very different sector.

AquaOne’s nucleus breeding and broodstock multiplication center, hatchery, and RAS farm are located in Hebei, near Beijing. The locations of AquaOne’s facilities have two advantages: (1) the breeding program is located far away from other shrimp production regions where disease is prevalent, and (2) the grow-out farm is located just 2,5 hours from Beijing and the cities around it (the Beijing city group), which market alone can consume 200 MT of live shrimp per day.

As a reference, AquaOne expects to produce 1,000 MT in two modules of 10,000 m2 this year. Within five years, the company aims to develop another 18 production modules. Combined, the company should then be able to produce around 10,000 MT annually—just a fraction of Beijing city group’s annual 75,000 MT live shrimp market.

Source: AquaOne Group

Source: AquaOne Group

The Chinese government supports RAS farms because of the high productivity of the production system versus the limited land and water use compared to many other production systems. In some cases, the government has provided companies with cheap access to land to develop new RAS projects. The RAS farms are built near China’s urban centers along the middle and Northern parts of China’s coastline, such as around Shanghai and Beijing. But in the future, they could also be est’blished more inland if demand in China’s second and third-tier cities picks up. Located close to the cities, the farms are perfectly suited to supply live shrimp to the cities’ wet markets.

The RAS farms produce shrimp with ’Igh stocking densities and can grow three to five crops annually. However, to reach their full potential, they need to deal with disease-related challenges, water filtration, and the high cost of production. Production costs in RAS are estimated to be around $5 per kg, and initial investments are high, but this does not prevent companies like Tongwei and CP from making them. They must invest in better genetics, high-quality feeds, high-end water filtration technology, and production automation. They are building the shrimp factories of the future.

Tongwei, for example, has announced investing $130m over ten years in building RAS factory farms for shrimp production. The company targets a production of 10,000 MT in 2023 but aims to grow its output to 1m MT in five to ten years. Although Dr. Guo acknowledges that it may be slightly ambitious, it indicates that such a potential expansion needs to be reckoned with. With CP, Haid, and Evergreen just starting their investment plans and many smaller players likely to follow, we can be confident that RAS farming will significantly contribute to China’s shrimp production in the mid or long term.

Estimating China’s Shrimp Production Volume Remains a Big Challenge

Dr. Guo explains that China’s domestic shrimp sector consists of different segments, both geographically and in terms of production systems. Chin’'s shrimp production for each segment can be estimated based on official government data, data from publicly listed companies, and anecdotal information. Unfortunately, there is a lot of discrepancy between these sources; therefore, any estimation must be taken with a good pinch of salt.

Based on his research, Dr. Guo estimates that China’s production of L. vannamei amounts to around 1.5m MT in salt water and approximately 0.5m MT in fresh (low salinity) water. The vast majority is produced in the South, but future growth should be expected more in the North. Some people think this is an overestimate, but based on earlier work that I have done myself in China, where we analysed feed sales, PL production, official sources, and expert opinions, I believe that we should in fact not underestimate China’s L. vannamei production and can comfortably assume that China produces at least 1.5m MT.

Will China Continue Importing Shrimp, or Will Domestic Production Outcompete Overseas Suppliers?

One of the central questions we asked Dr. Guo and the other panelists is whether they believe that Chinese production may compete with overseas supplies. They say not to worry about it because domestic producers and overseas suppliers cater to different markets, and both markets continue to have growth opportunities. But a lot will depend on the Chinese economy and whether Chinese consumers can continue to afford shrimp.

The panel dived into China’s two distinct shrimp markets. One for live shrimp, mainly sold through China’s wet markets (remember the statement above about the Beijing city group, which, according to Dr. Jin, consumes 200 MT of live shrimp daily). And one for (re-)fresh and frozen HOSO and value-added shrimp, sold primarily through distributors, food service, e-commerce, and retail channels. Most of China’s domestic production (probably around 75%) is supplied to the wet markets. The remainder and imported shrimp are provided to the (re-)fresh and frozen HOSO and value-added shrimp market.

The main reason that China’s shrimp producers supply the live shrimp market is their cost of production. According to Dr. Guo, Chinese producers in ponds, greenhouses, and RAS farms produce at a cost of approximately $3.5, $4, and $5 per kg, respectively. Ecuador supplies China at a CIF cost of, on average, $5 per kg. While Chinese producers can make decent margins in the live market, were they to compete with Ecuador and other suppliers in the (re-)fresh and frozen HOSO and value-added markets, they would have to compete at tiny margins, and it’s unlikely they would be able to do so. To stay ahead of their domestic competition, Chinese RAS farms aim to produce larger sizes, which pond and greenhouse farmers cannot produce.

The panel agrees that there will be ample opportunity for growth in both markets as long as the Chinese economy does not collapse. Expanding shrimp consumption in second and third-tier Chinese cities further inland is a significant opportunity. With today’s relatively cheap prices, consumers with lower purchasing power in those cities can taste shrimp. Once shrimp becomes part of restaurant menus and people start cooking shrimp at home, there will be a fresh market for local RAS farms to supply to and a (re-)fresh, frozen, and value-added market for domestic processors and overseas suppliers.

The panelists emphasize that Chinese consumers will always keep their taste for live shrimp. Whether it is for pregnant women believed to benefit from the nutritional value of shrimp or for Chinese New Year celebrations with family and friends, Chinese consumers are often willing to pay a high price for a live product. Therefore, overseas suppliers should aim to develop their market for frozen HOSO and value-added shrimp instead of considering to compete with Chinese domestic producers for the live shrimp market.

Not Such a Black Box After All

Dr. Guo jokingly asked whether the GSF description of his presentation talked about a black box or a black hole in terms of China’s domestic shrimp farming sector and shrimp markets. Fang Qing, ASC’s General Manager for China in the panel, strongly argued that it’s definitely not a black box. A lot of information about China’s production sector and markets is available but you need to be able to access the information. And the language barrier for non-Chinese speakers is the real limitation. But luckily, according to the panel, it may turn out over the next couple of years that there is a black hole in China in terms of its ability to absorb a rise in Chinese live shrimp production from the rapidly emerging RAS farming sector, as well as at least a million MT (but hopefully even more) of imported shrimp for China’s frozen market and value-added industry. I will do my utmost best to continue to unwrap China’s domestic shrimp farming sector in future publications and in next GSF editions.

That said—save the date! The third edition of the Global Shrimp Forum will take place in the Netherlands from 3-5 September 2024! Be there (or be square)!