In the previous weeks, I’ve shared my thoughts with you about the developments in India and Indonesia in 2020 as well as my outlook for both countries in 2021 and beyond. In this blog, we will look at Vietnam’s performance in 2020 and my outlook for the country for 2021 and beyond. To round up this series of three blogs, I will also share my thoughts on the increased Ecuadorian competition in Europe and the US.

SIGNIFICANT GAP BETWEEN VIETNAM’S PRODUCTION DATA AND LIVE WEIGHT EQUIVALENT OF EXPORTS

According to Vietnam’s Department of Fisheries (DoF), shrimp production in Vietnam increased from 2019 to 2020 despite COVID-19. The authority reports a 10% increase in L. vannamei production (to 632,000 MT), a 1% growth of P. monodon production (to 267,700 MT) and a production of 50,000 MT wild-caught shrimp. This would bring Vietnam’s total shrimp production to nearly 950,000 MT.

While these numbers are impressive, I’m afraid they might not be accurate. Although Vietnam doesn’t report export volumes itself, mirror data of Vietnam’s trading partners reveals that the country exported around 315,000-325,000 MT in 2020. With a ratio of 0.6-0.7 this would represent a live weight equivalent (LWE) of 450,000-540,000 MT. Even with an LWE ratio of 0.5, exports wouldn’t account for more than 650,000 MT of live shrimp.

There are some factors that could explain the 300,000-500,000 MT gap between reported production and reported exports. For example, Vietnam’s domestic market could be much larger than I assume or informal exports to China could absorb a significant part of production. Or perhaps Vietnam’s exporters have built significant inventories. Even so, it’s also plausible that the DoF has at least slightly inflated its data.

VIETNAM CLOSED THE YEAR WITH ONLY A SMALL DECLINE IN TOTAL EXPORT VOLUME

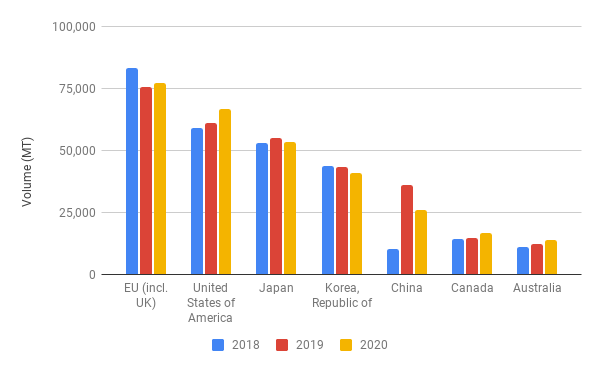

Import volumes reported by Vietnam’s main trading partners (Figure 1) reveal that exports to the EU, the US, Australia and Canada increased, but exports to China and Japan decreased. Combined, these largest markets imported only 1% less Vietnamese shrimp compared to 2019 (below 5,000 MT) and 7% more than in 2018.

Figure 1: Vietnam’s export markets from 2018-2020 according to volume

Source: Trademap

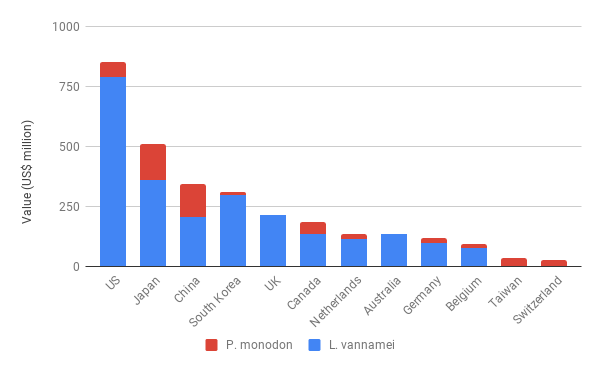

In its 2020 Seafood Export Statistics Report, the Vietnamese Association of Seafood Exporters and Processors (VASEP) shows a breakdown of P. monodon and L. vannamei exports per market (Figure 2). Unfortunately this is provided only in values and not in volume, but it does reveal that exports to Europe and the US primarily consist of L. vannamei shrimp, while exports to China and Japan consist to a large extent of P. monodon.

Figure 2: Vietnam’s main export markets according to value in 2020

Source: VASEP

Note: VASEP sells quarterly seafood trade data reports that are much more detailed compared to other sources. These reports only cost around $100 and I would recommend everyone following Vietnam’s performance to subscribe to VASEP’s publications.

According to VASEP, the top five markets for P. monodon in 2020 were Japan ($146m), China ($136m), the US ($64m), Canada ($47m) and Taiwan ($33m). The main markets for L. vannamei were the US ($789m), Japan ($361m), South Korea ($296m), the UK ($214m) and China ($207m). Unfortunately, VASEP doesn’t provide specific data at species level for Europe as a whole, but its data states that the UK, the Netherlands, Belgium and Germany combined imported $498m worth of Vietnamese L. vannamei, making Europe definitely the second-largest market for Vietnam’s L. vannamei in 2020. For P. monodon, Europe plays a much smaller role.

L. VANNAMEI EXPORTS INCREASED BY 15% WHILE P. MONODON EXPORTS DECLINED BY 16%

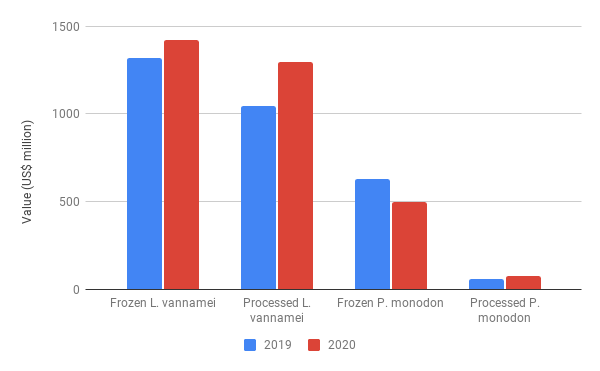

Vietnam’s total export value of farmed shrimp increased from $3.1bn in 2019 to $3.3bn in 2020, an 8% increase. In accordance with the DoF’s data, VASEP’s export figures show that L. vannamei exports have driven this increase, as their value increased by 15% year-on-year to $2.7bn. At the same time, the value of P. monodon exports dropped year-on-year to $575m, or 16%. Within L. vannamei exports, compared to raw frozen products, especially exports of cooked and other value-added products increased drastically (Figure 3). This is most likely a result of increased demand for cooked products in the retail markets.

Figure 3: Vietnam’s farmed shrimp export products according to value in 2019-2020

Source: VASEP

The US indeed increased its imports of cooked shrimp from Vietnam by more than 50% or 12,000 MT (Table 1). Cooked shrimp now accounts for more than 50% of Vietnam’s total exports to the US. Interestingly, exports of raw peeled shrimp remained stable and exports of shell-on shrimp to the US even declined. Vietnam has thus only been able to profit from the US’s increased appetite for shrimp in the cooked segment. In the raw peeled and headless shell-on (HLSO) segments, Vietnam seems to be surpassed by Indonesia and Ecuador, which increased their exports of those products.

Table 1: Vietnam’s export products to the US

Source: NOAA

VIETNAM MAY HAVE EXPECTED MORE FROM NORTH-WESTERN EUROPE

With a volume increase of only 2% compared to 2019, Vietnam’s growth curve in 2020 wasn’t as steep as the country anticipated. Within north-western Europe, the largest market for Vietnam’s shrimp in Europe, Belgium increased its imports the most (15%) followed by the Netherlands (3%) and Germany (2%). The UK, although officially not part of the EU anymore, is still the largest European market and increased its imports by 4%. France, on the other hand, reduced its imports from Vietnam by 20%. With these numbers, Vietnam remains by far the largest supplier of raw peeled and cooked peeled shrimp to north-western Europe.

Even though Vietnam managed to increase its exports to Europe, its Free Trade Agreement (FTA) with the EU might have raised the expectations of Vietnam’s exporters. A slow European market due to COVID-19 and possibly increased competition from Ecuador might be the reasons for the moderate growth of Vietnam’s exports to Europe. Loss of market in China prompted Ecuador to look for other markets and, just like Vietnam, it had an FTA with the EU in place and targeted the north-western European retail segment. In doing so, Ecuador may have taken some raw peeled retail business away from Vietnam, which used to be north-western Europe’s most favorite supplier.

IN 2020, ECUADOR FIERCELY COMPETED FOR MARKET SHARE IN MARKETS TRADITIONALLY DOMINATED BY ASIAN SHRIMP

I won’t reflect extensively on Ecuador’s exports, but I’d like to share my thoughts on how Ecuador’s need to diversify its markets might influence the playing field for Asia’s exporters of shrimp to Europe and the US.

Last year, Ecuador increased its export volume to 670,000 MT, a 7% growth compared to 2019. It did come at a cost. Farm gate prices dropped to all-time lows, largely due to China’s reduced demand for Ecuadorian shrimp, which resulted in 9% (or 44,000 MT) less imports and a drastic decline in price for the shrimp that had already been imported. Combined with the increase in total exports, Ecuadorian packers had to sell almost 80,000 MT more shrimp than in 2019 in markets other than China. This made Ecuador’s exporters turn to, among others, the US and Europe. The share of these markets in Ecuador’s total exports increased from 12% to 17% and from 19% to 22% respectively. This equaled a 50% increase in exports from Ecuador to the US and a 27% increase in exports from Ecuador to Europe.

Figure 4: Garlic shrimp from Ecuador in a Dutch supermarket

Source: www.ah.nl

Market diversification was already on Ecuador’s agenda. The country’s Chamber of Aquaculture (CnA) and Sustainable Shrimp Partnership have been aggressively promoting Ecuadorian shrimp and aim to set it apart from its Asian competitors, claiming sustainability and a premium quality. With this strategy Ecuador attempts to enter the retail markets of the US and Europe, which so far have been dominated by Asian suppliers. In north-western Europe, for example, Ecuador only used to supply primarily small volumes of HOSO and organic certified peeled products, and now has started to compete in the raw peeled segment as well. In 2020, the Netherlands, Belgium and Germany increased their imports from Ecuador by respectively 122%, 90% and 51%. Exports of peeled products to the US increased by 52%. Of course supported by low prices, retailers in Europe and the US seem to start recognizing the premium position of Ecuador’s shrimp, making Ecuador a fierce competitor of Asian suppliers of the same products.

ECUADOR’S COMPETITION IN RETAIL IS HERE TO STAY BUT THE LARGER VOLUME MAY SOON RETURN TO ASIAN MARKETS

Although part of Ecuador’s increased exports surely consists of value-added products for the retail markets in the US and Europe, part also consists of HLSO products. Partly as raw material for producers of value-added products, but primarily as HLSO products to be sold in the wholesale segment, which normally might have been exported to China. For these products, Ecuador’s exporters may return to China once the country’s demand recovers in 2021.

In my opinion, Ecuador’s drive to diversify its market can, at least partly, be explained by the fact that along with its increase in total shrimp production, the volume of shrimp that lacks HOSO or even HLSO product quality also increases. This type of shrimp needs to be processed into peeled products for which the biggest markets are the retail markets in the US and Europe. I’m not convinced that Ecuador’s exporters aim to increase their share of value-added products beyond this point as the business case for peeled products in Ecuador might still be weak compared to that of its Asian peers.

CONCLUSION

From my analysis in these previous three blogs in which I reflected on the performance of Asia’s three main shrimp producers in 2020, I conclude that Vietnam and Indonesia performed much better than many might have expected, while India struggled with the consequences of the COVID-19 pandemic. Even though Vietnam and Indonesia did well, all Asian producers had to deal with Ecuador’s increased competition in US and European supermarkets. Ecuador’s exports of HLSO products to the wholesale segments in the US and Europe may be of a more temporary nature and this significant part of Ecuador’s exports may return to Asian markets once demand recovers post-COVID-19. Meanwhile, Ecuador’s products in the retail markets are likely here to stay and Asian suppliers, especially of raw peeled products, will need to step up their game to keep up with Ecuador’s premium market image.