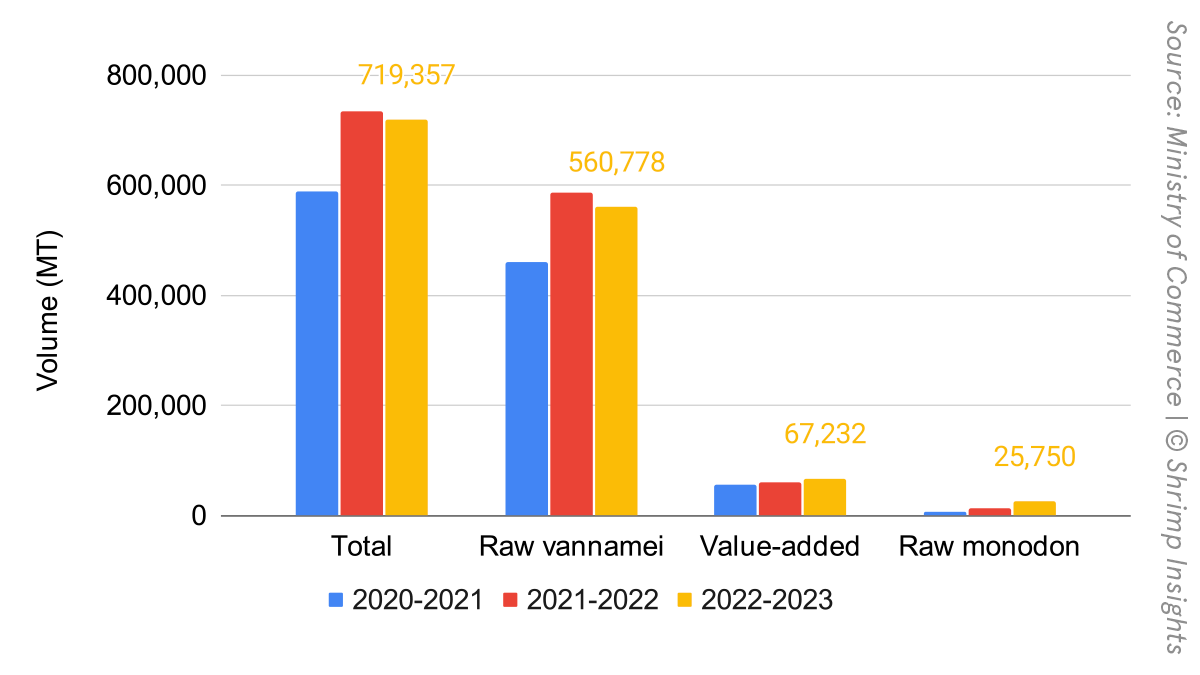

Indian authorities recently reported a financial year (April–March) total export volume of 719,357 MT for 2022–2023, still above the 588,743 MT in 2020–2021 but down from 734,375 MT in 2021–2022. Raw vannamei amounted to 560,778 (4% down from 2021–2022) and was responsible for most of the decline. Value-added shrimp amounted to 67,232, 10% up from 2021–2022, and P. monodon amounted to 25,750, 90% up from 2021–2022. The increases of value-added and P. monodon exports confirm the move of Indian exporters into more value-addition and the move of some farmers away from L. vannamei.

Some may have expected that India’s financial year export volume in 2022–2023 would have been much lower than it was. The less dramatic figures resulted from the large volume of raw material harvested in Q4 2022 when farmers had already stocked their ponds before prices collapsed. The export volume in Q1 2023 reached 131,766 MT, up 16% compared to 2022. While the volume was up, prices spiraled down as average export prices dropped to $6.53/kg for raw L. vannamei in December 2022, for value-added products to $9.15/kg in February 2023, and for raw monodon to $9.18/kg in March 2023. While exports to the US dropped, exports to China and other Asian markets increased.

Only in April 2023, India’s monthly exports of raw vannamei shrimp dropped below 2022 levels as they fell to 40,248 MT, down from 45,741 in 2022. In April, also, exports of value-added products, which till then showed a more positive trend, dropped year-on-year. The drop in exports may finally be the first sign that the output of India’s first crop has dropped, which would be in line with the strongly declined broodstock import numbers (from December 2022 to May 2023 down 33% compared to the same period a year before). Luckily, amidst slower production export prices seem to have reached their lowest level. A market correction seems to be underway.

Noteworthy, contrary to the drop in vannamei volumes, exports of P. monodon shrimp continued to rise in April. The year total over the first four months already reached 8,511 MT, compared to only 3,200 MT and 1,515 MT over the same period in 2022 and 2021, respectively. This is a sign that, although slower than some people in the Indian farming fraternity may have expected, an increasing number of farmers is using the improved availability of domesticated healthy and fast-growing P. monodon PL.

Do you need a more detailed analysis of India’s export data to understand market dynamics better? Let me know; I have all the data and will facilitate a workshop for you or your team.